FAQ: 3D Secure

What is 3D Secure?

3D Secure is a collective term for the security standards Verified by Visa and MasterCard SecureCode which are developed by Visa and MasterCard, respectively.

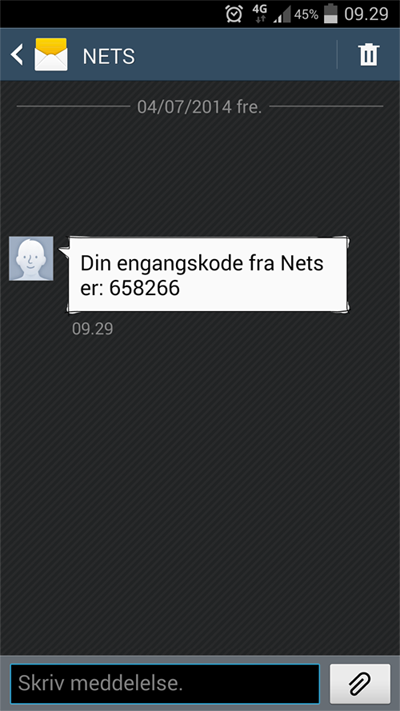

When 3D Secure is used, an extra security measure is added to the payment process. After the customer has entered her credit card details, she will receive a one-time password via SMS, which she has to enter to complete the purchase. You can see how the password might look in the image below.

3D Secure only applies to international payment cards and cannot be used with Dankort payments.

Please note that some acquirers require the use of 3D Secure. Contact the acquirer for further information.

What are the advantages of 3D Secure?

When a payment is completed with 3D Secure, it improves your security significantly in the event of fraud. As a rule, you do not assume the risk – which you do when 3D Secure hasn’t been used. The card issuing bank assumes the risk when 3D Secure is used, and if you comply with your acquirer's legal requirements, chargebacks are not permitted.

We strongly recommend that you use 3D Secure.

What are the disadvantages of 3D Secure?

Consumers from all over the world know 3D Secure and feel secure using it. However, in Denmark – where 3D Secure is not a household name – some customers feel insecure when faced with the unfamiliar names and logos of 3D Secure and abandon their shopping cart.

Thus, when it comes to Danish customers, you run the risk of missing out on potential revenue. Yet, as for foreign customers, 3D Secure improves your security significantly, and we recommend that you always use 3D Secure.

Where do I change the settings for 3D Secure?

Please contact us at support@epay.dk to change your 3D Secure settings.

You can choose between four different levels:0. Don’t want to use 3D Secure

Choose this if you don’t want to use 3D Secure at all.

1. Payments in DKK (Danish krone) with a danish card are completed as normal payments and the rest as 3D Secure

2. Payment cards that support 3D Secure are processed as 3D Secure and the rest as SSL payments

All payment cards that support 3D Secure will be processed as 3D Secure. Ultimately, this equals the optimum security for your business.

Wether Visa/Dankort payments are processed with 3D Secure depends on your acquirer. As mentioned above, 3D Secure only applies to international cards for which reason it depends on whether the acquirer processes the payment through the Visa or Dankort part of the Visa/Dankort payment card.

Since Nets is the only acquirer capable of cashing in the Dankort, all other acquirers will usually process the payment through the Visa part, thus making 3D Secure possible.

3. Accept only payment cards that support 3D Secure – the rest will be rejected

Choose this if you want to reject all payments with payment cards that do not support 3D Secure. As such, this is the safest way to go – but it also involves the largest financial losses since payments with Dankort are rejected.

You can set up more specific rules for the use of 3D Secure with our security product Fraud Fighter. Among other things, you can control which countries and regions should use 3D Secure, and set up an amount limit that activates 3D Secure.

Read more about Fraud Fighter here.

How does 3D Secure work in practice?

When a customer meets 3D Secure, she receives a one-time password via SMS. The first time 3D Secure is used, the customer has to sign up and associate her mobile phone number with her payment card. She’ll need her NemID (a Danish log-in solution) to do so.

The next time she’s about to pay in an online store that’s using 3D Secure, she receives a password on her phone and must enter it on the screen to verify the purchase.

This method was effective from October 30, 2013. Before then, customers had to use a personal message and a password they had to remember.