Use of Fraud Fighter

Before you start using Fraud Fighter, there are a few things you should know. Understanding the line of thinking behind the product is important to use it correctly.

Fraud Fighter protects your business by:

-

Comparing the country which issued the payment card to the country from which the purchase is made (using the IP address). If the card issuing country does not match the IP address, it might indicate fraud.

-

Monitoring all your payments on the basis of a number of rules that you define. If there is a suspicious payment, you’ll receive an alarm on email. You can adjust the level of security through the rules you set up. When you receive an alarm, it’s up to you whether or not you want to capture the amount and ship the product.

-

Blocking suspicious payments. You can even block specific IP addresses if you experience several fraudulent attempts from the same place.

As stated above, Fraud Fighter is governed by a number of rules that you define. A rule is based on either a country or a region, and you create a rule by choosing from a list of predefined settings. You can create a rule that applies to an entire region, and if there’s country in that region which you don’t want to be affected by the rule, you can create a rule specifically for this country. As such, country specific rules overwrite region specific rules, thus granting you full control of the rules that govern Fraud Fighter.

Example

Let’s look at a few examples:

You can create a rule that blocks all payments from the region Africa. If you want to exempt Egypt from this rule, find Egypt in Country specific rules and create a different rule for this country.

Or maybe you want to accept all payments from Scandinavia without forcing the customers to use 3D Secure. However, since Swedish customers are used to 3D Secure, you want 3D Secure on all payments from Sweden. First you define one rule for Scandinavia (region specific) and another rule for Sweden (country specific).

Fraud Fighter alarms

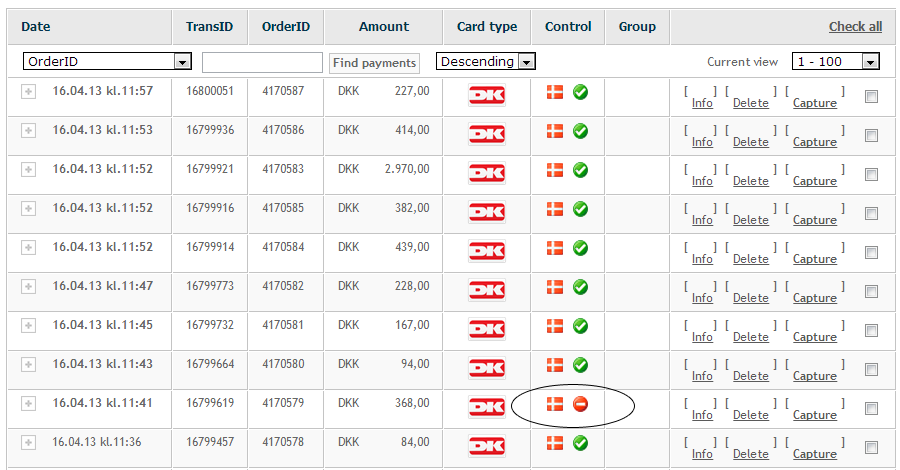

If you have set up a recipient of Fraud Fighter alarms, you’ll receive an email containing further information if there is a suspicious payment. A suspicious payment is recognisable in the ePay administration as it is marked with a little red stop sign (see the image below). If you click on ‘Info’ on the right, you’ll find a statement accounting for why the payment was suspicious in the field “Fraud Fighter”.

Payments which are blocked by Fraud Fighter are found in your ePay administration in the menu Fraud Fighter -> Declined payments.

How much does it cost?

You can find the price per transaction in your ePay administration from the menu Fraud Fighter -> Overview.

Do you know what 3D Secure means to you?

3D Secure is a collective term for the security standards Verified by Visa and MasterCard SecureCode which are developed by Visa and MasterCard. When your customers use 3D Secure, there is, in most cases, no risk involved for your business in the event of fraud. You do not assume the risk – which you do if 3D Secure hasn’t been used. The card issuing bank assumes the risk when 3D Secure is used, and if your company complies with the legal requirements, you will not receive a chargeback.

We recommend that you use 3D Secure.

Please note that 3D Secure only works with international payment cards. It is not compatible with Dankort.

What is a chargeback?

When card holders discover suspicious transactions on their bank accounts, they’ll usually contact the bank and have the card revoked. The bank will cover the card holders’ loss, and make a chargeback against the company where the purchase was made. The company must then compensate the bank for their loss (the money is charged back from the company to the bank), and in some cases, the bank will charge the company for the costs.

The result is that the company loses both their money and the product.